Most people leave hundreds of dollars on the table each year without realizing it. The average American household loses $1,200+ annually to preventable financial leaks. Here are the 5 biggest culprits—and how to plug them.

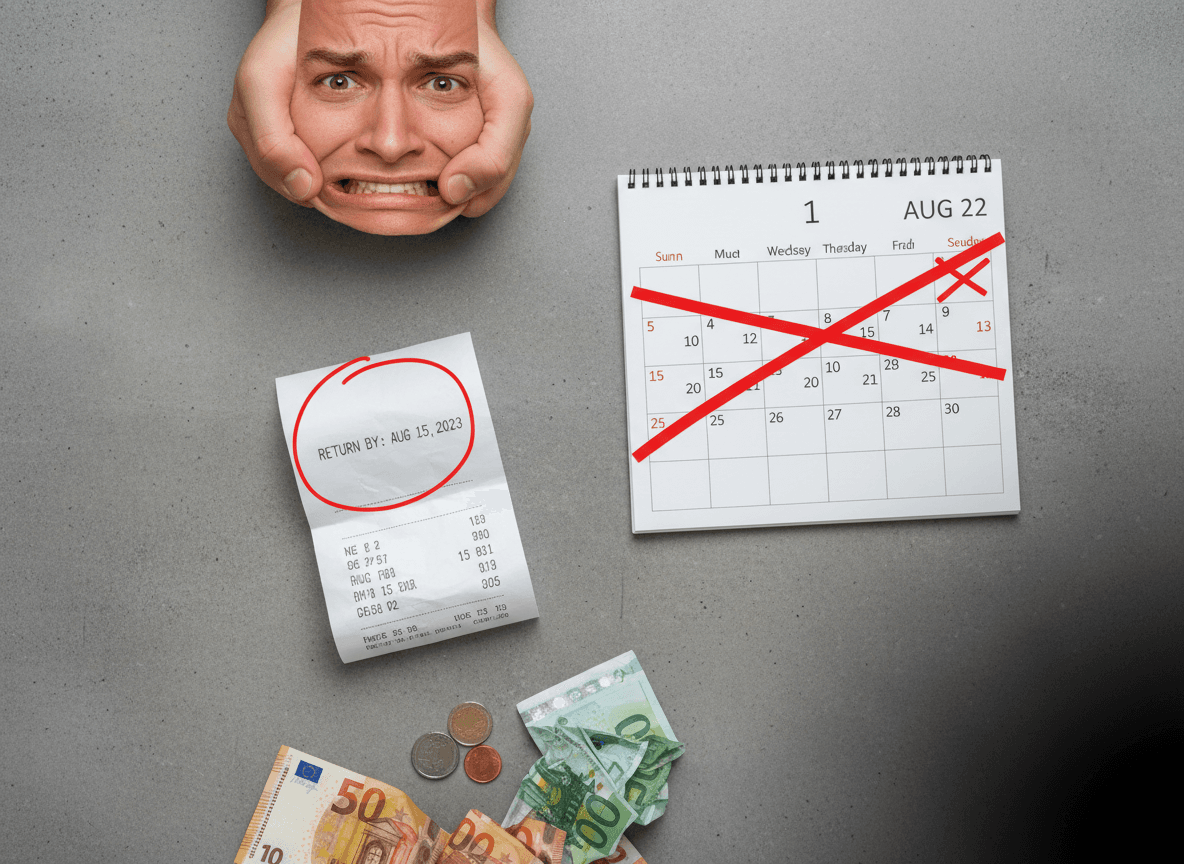

1. Missed Return Deadlines 📦

That sweater that didn't fit? The gadget that was DOA? They're sitting in your closet because you "forgot" to return them. Retailers count on this. In fact, they design return policies to be just confusing enough that most items never make it back.

The Problem: The average person has 3-5 items at any time that could be returned but won't be—worth an average of $76 each.

The Fix: Track your purchases and set reminders 7, 3, and 1 day before return windows close. Better yet, let an AI do it for you.

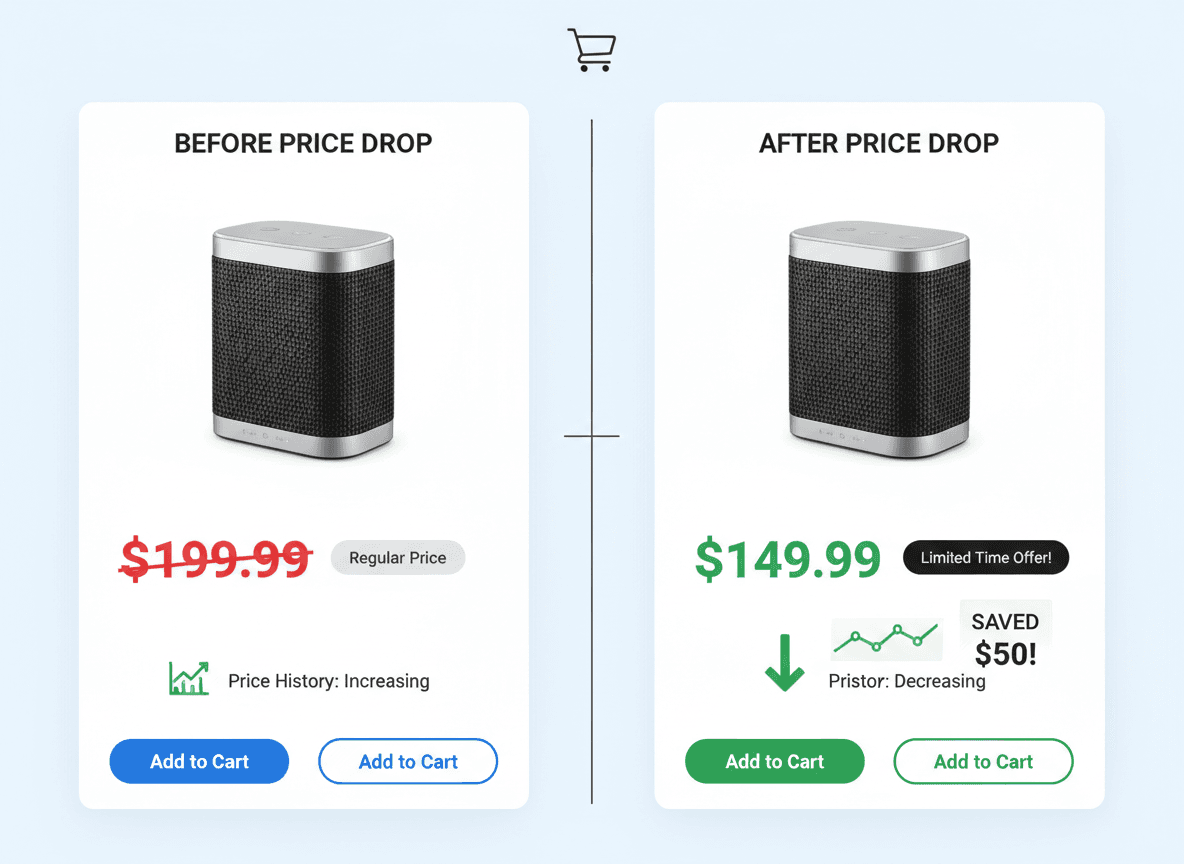

2. Price Drops Within Your Return Window 💸

Did you know that if something you bought goes on sale within your return window, you can often return it and rebuy at the lower price? Most people don't—and retailers aren't exactly advertising this.

Real Example: You buy a $89.99 air fryer from Target. 8 days later, it drops to $61.99. You could save $28 by returning and rebuying—but only if you notice.

The Fix: Monitor prices on recent purchases automatically. When something drops, get alerted immediately so you can act before the window closes.

3. Forgotten Subscriptions 🔄

The free trial you forgot to cancel. The streaming service you haven't used in 6 months. The gym membership collecting dust. These "small" charges add up fast.

The Damage: Americans waste an average of $133/month on unused subscriptions. That's $1,596 per year—gone.

The Fix: Get notified before every subscription renewal. Cancel what you don't need before you're charged again.

4. Expired Warranties 🛡️

Your laptop battery is failing. Your blender stopped blending. Your headphones only work on one side. All potentially covered by warranty—if you file a claim in time.

The Reality: 70% of warranty claims are never filed, even for products with known issues. That's money left on the table.

The Fix: Track warranty expiration dates and get reminded before coverage ends. File claims while you still can.

5. Irrelevant "Deals" That Waste Your Time 🎯

Not every sale is a good deal. Flash sales, limited-time offers, and "exclusive" discounts are designed to create urgency—not save you money. Chasing deals on things you don't need is just spending with extra steps.

The Truth: The best savings come from recovering money on things you've already bought—not finding new things to buy.

The Fix: Focus on protecting the purchases you've already made, not hunting for the next deal.

The Bottom Line

These 5 money leaks cost the average household over $1,200 per year. The worst part? They're completely preventable—if you have the right tools.

What Smart Shoppers Do Differently

They don't rely on memory. They don't set manual reminders. They use automated systems that track deadlines, monitor prices, and alert them before money slips away.

Your Next Step

Stop leaving money on the table. Join thousands of smart shoppers who are plugging these leaks automatically.